Looking for a car insurance comparison in St. Louis?

We’ve got you covered.

In today’s world with the amount of technology we have, there are an abundant of distracted drivers on the road every single day. If you have a vehicle, auto insurance is something that is crucial to have. Auto insurance doesn’t just cover damages to your vehicle, it covers much more.

You are at risk every single day you get in your car.

It’s important to understand what coverage options are provided for your car, yourself and for the people who may be injured in the accident as a result of your negligence.

Having adequate car insurance limits is serious business.

If you were ever involved in an accident and found to be at-fault for someone else’s bodily injuries, you could literally lose everything if you’re not properly insured.

What a lot of people don’t realize is, having great coverage doesn’t necessarily mean having higher insurance premiums.

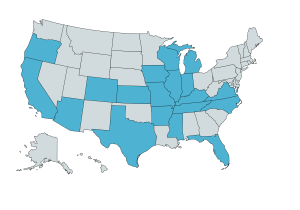

Graves Insurance Group is 100% independent. We can take your current coverages and compare them with a wide range of insurance providers to see who offers you the best deal possible.

The best part? It doesn’t cost you a penny more to use us. We are compensated by the insurance carriers directly, and work on your behalf to properly cover your needs and exposures. We make sure that there are no hidden gaps in your policy.

While comparing two policies side-by-side might look the same, the fine print behind the cover page can vary from company to company. You need someone who understands policy contracts like us to sort through the exclusions and conditions for you, so you can rest easy knowing that you have the best possible coverage at a fair price.

Important Auto Insurance Coverages

Looking through your policy may be a little confusing and might raise questions as to what they are, and why they are on your policy.

Let us clarify a few of the more important ones for you:

Collision Coverage — This part of your policy covers damages to your vehicle if it is damaged in an accident with another vehicle or object, such as a guard rail or home.

Comprehensive Coverage — This part of your policy also protects damage against your car, but not subsequent from an accident. A few examples include: theft, a rock hitting your windshield, hail, fire, etc.

Property Damage — This part of your policy compensates damage you cause to another person’s property. Suppose you hit another person’s property like a fence or their home, it will be compensated.

Bodily Injury Liability — This part of your policy protects you when you are legally responsible for a car accident and pays for the costs associated to the other people or persons involved. Due to the high cost of medical care, it’s dangerous to carry liability limits that are too low. This is something we can help you decide on.

Un-insured & Under-insured Liability — This part of your policy protects you in an event that if you are injured by a second party who is either unidentified, or they do not have enough Bodily Injury insurance to cover your expenses. This is an extremely important part of your policy because you have zero control over how much insurance other people are driving around with.

Common Auto Insurance Rating Variables

Your age— Age is important because insurance companies use your age to determine the rates of your policy. If you are either under 25 years old or over 65 years old, typically you will not get preferred rates due to statists of those ages casing the most accidents. In addition, if you are a student, you might be in line for a discount.

Your Credit History — Credit has been used in the insurance industry for many years to determine your score. The better your credit, usually your rates will be more favorable.

What you drive — Your car depends on what type of rate you will be provided. It fluctuates on the type of your car, engine size, safety features etc.

Driving History — Your driving record is extremely important to think about not only for injuries to yourself and other parties, but it plays a role in what kind of rate you will get. If you have violations on your driving record, chances are you will not receive a preferred rate until 3 years subsequent of the prior recorded rate.

Household — Insurance companies like to look how many drivers there are in your household. If there are multiple drivers under the age of 25 or over the age of 65, pricing on your policy will be altered.

How to get started with your quotes

If you live in St. Louis and are looking for a car insurance comparison, Graves Insurance makes the process of finding the best company and price easy.

We do all the heavy lifting for you!

To get started, call our office directly, or click over to our Quotes page to send us some basic information about your needs so we can get started on your policy review and comparison!